are assisted living expenses tax deductible irs

Unfortunately many people do not realize that. Children caring for their disabled.

Are Assisted Living Costs Tax Deductible

Is Assisted Living Tax Deductible.

. Yes in certain instances nursing home expenses are deductible medical expenses. For group A the IRS says the entire cost of their stay is tax-deductible. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care.

According to the Internal Revenue Service IRS taxpayers are allowed to deduct the cost of assisted living partially or in full if you qualify. Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that you paid. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia.

Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of. This includes meals and lodging. The IRS will have requirements so the family members can assisted living home expenses nursing home expenses and also treatments for Alzheimers disease.

As long as the resident meets the IRS. The good news is that a part or the entire sum of your assisted living costs might qualify for tax deduction. Medical expenses generally make up at least a portion of the monthly service fees and entrance fees at assisted living communities.

The majority of the one million American seniors living in assisted living communities pay the fees with their own money. With a median cost of nearly 4000 assisted. An assisted living facility is a long.

The IRS says to list deduct medical expenses on Schedule A of Form 1040 as you figure out whether your itemized deductions reduce your federal income tax more than your. If you your spouse or your dependent is in a nursing home primarily for medical. If you or your loved one live in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction.

According to the IRS. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. See the following from IRS Publication 502.

IRS Publication 502 allows all medical and dental expenses to be deducted that cost more than 75 percent of adjusted gross income. When it comes to group B this is not the case. The fact is that the IRS has stated that any qualifying medical.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. For tax purposes assisted living expenses are classified as medical expenses. The deductions are documented on Schedule A of your Form.

In order for assisted living.

Publication 554 2021 Tax Guide For Seniors Internal Revenue Service

Claiming An Elderly Parent As A Dependent Agingcare Com

Irs Reveals 2022 Long Term Care Tax Deduction Amounts And Hsa Contribution Limits Ltc News

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Tax Deduction For Weight Loss Camp

Your 2020 Guide To Tax Deductions The Motley Fool

List Of Assisted Living Tax Deductions Retirement Savior

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Assisted Living And Tax Deductions

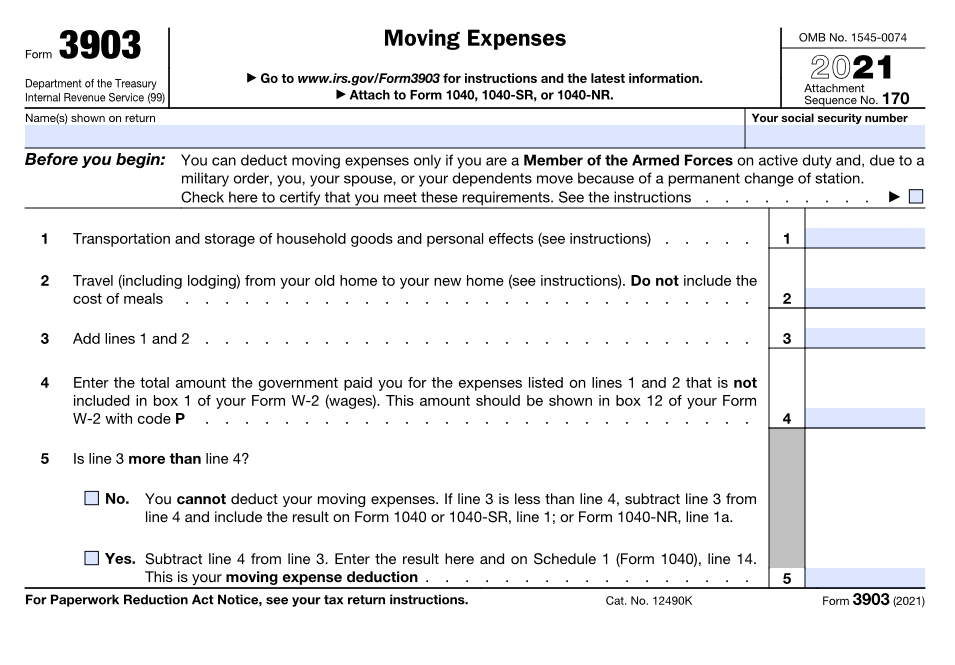

New Tax Twists And Turns For Moving Expense Deductions

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

List Of Assisted Living Tax Deductions Retirement Savior

Is Assisted Living A Tax Deductible Expense Carepatrol Blog

You Can Deduct These Retirement Community Fees As Medical Expenses Marketwatch

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

Assisted Living Can Be Tax Deductible Salmon Blog

Are Moving Expenses Tax Deductible Smartasset

![]()

List Of Assisted Living Tax Deductions Retirement Savior

How To Deduct Assisted Living And Nursing Home Bills Hesch Cpa